WHY THIS MATTERS IN BRIEF

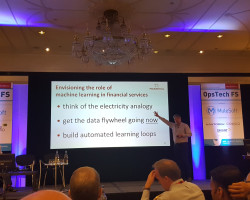

The financial services industry is going through one of the greatest transformations since its inception as it tackles not one disruption but three, namely AI, Blockchain and “Digital”

Yesterday, and much to the chagrin of the audience of financial services professionals and executives who I’m sure were bored senseless by my shenanigans, it was my privilege to be the Chairman for the day MC’ing MarketForce’s prestigious London OpsTechFS 2017 event – the fact that they even invited me must surely mean that they were scraping the bottom of barrell but hey hoo!

The day started promptly at 9.30am, and, I have to say that the commute into London was superb. Given the fact that I travel all over the world it was a genuine pleasure to pay South East Rail (SER) the best part of a hundred pounds to sit on the floor by the toilet in a commuter train that was so packed it would have sardines complaining about the cramped conditions. And yes SER I’m calling you out because the delayed train on the way back that made the first train look like first class sucked away all my complaining tweeting energy.

Think happy thoughts, think happy thoughts.

[tvo_shortcode id=7889]

All in all around three hundred people attended the event throughout the day and it was a veritable bun fest of who’s who with over a hundred corporate giants and fintechs mingling together in the Marriott Grosvenor Square Hotel to discuss and share ideas on everything from digital transformation and automation, all the way across to security, the evolution of the workforce, analytics and the world of connected oojamaflips.

Browse the Photo Gallery

The event kicked off with me chatting through the future of financial services, and discussing the rise of fully autonomous organisations on Wall Street and the rise of Quantitative trading (Quants), and stealing everyone’s biometric ID’s so I could log in to their bank accounts when they weren’t looking by taking a photo of them all (see the gallery above) – frankly, that’s what happens to you if you attend an event I’m at and you don’t read my blog in advance otherwise they’d have all known how criminals can steal your biometric information, including facial, fingerprint, and iris scans easily from photos and from voice recordings. Tut tut is all I can say.

Rest easy though everyone, I’m trust worthy and your bank accounts are safe – if only for the fact that the photo I took (see the gallery above) looks like I tied my phone to a cat then clicked the button – seriously Apple, you can’t figure out how to make a phone that takes decent photos in doors!? However, that said, and Futurist hat back on, one day I’ll be able to sharpen it up perfectly using Google RAISR so beware!

You noticed, I have my ranty hat on today… it’s the UK heatwave I promise…

First we heard from Sebastian Antony, Director of Transformation at Barclaycard whose material I stole – or did he steal mine? Robots, the Singularity and Quantum computing is my realm Sebastian, sorry… and he did a great job at explaining how he and his team are helping to automate Barclaycard’s services. Then we heard about the latest in Artificial Intelligence (AI) from Dr Michael Natusch, Global Head of AI, Prudential and next up came Barclay’s Anthony Masey, Head of Blockchain R&D at the bank who’s blockchain presentation managed to simplify what at least 90 percent of the audience thought was a difficult topic (still).

Next onto the stage bounced two vibrant young start ups Paul Worrall, Founder of Zonafide, who are trying to use the collaborative power of blockchain to counter fraud, and Balazs Nemethi, CEO of Taqanu Bank who is trying to help the 2 billion people on the planet without any proof of ID get banked, and if you haven’t already you should check them out.

Asides from my MC’ing duties I also chaired a number of panel sessions discussing what else but blockchain and automation. When it came to blockchain we, that is Anthony Macey, Barclays, Dr Michael Natusch, Prudential and Rob King ex LV and I discussed where, why and how you get started with it. Then later on Elliot Biggs, Strategic Development Director, Ageas, Paul Titterton, Managing Director of Barclays Premier Distribution and Will Beeson, Head of Operations and Innovation, CivilisedBank, and I, discussed the Evolution of the Workforce.

Today, as organisations accelerate automating repetitive lower office and middle office cognitive tasks and jobs, such as the automation programs being run at JP Morgan and Goldman Sachs show, and as even the CEO’s enter the automation firing line, it’s fair to say that this topic, as the readers of my blog will know all too well, where we discuss the rise of Robo-Automation, had the potential to be the most contentious. Broadly though the panel came to the conclusion that automation, especially cognitive automation and Robotic Process Automation (RPA) is a growing trend and it will continue to displace sectors of the workforce but that communication, leadership and workforce re-education and re-tasking ahead of time are becoming especially important as we race into the future.

And as for me, as the event came to a close, well, I had to pile back onto the London tube and the trains and, well, you know how well that went… long live Dubai’s sky taxis’ and thanks to the organisers and everyone who attended.

[…] that wasn’t the feeling of a lot of the banking executives that attended last week’s MarketForce OpsTechFS 2017 conference in London […]